Revenue-Based Property Loans

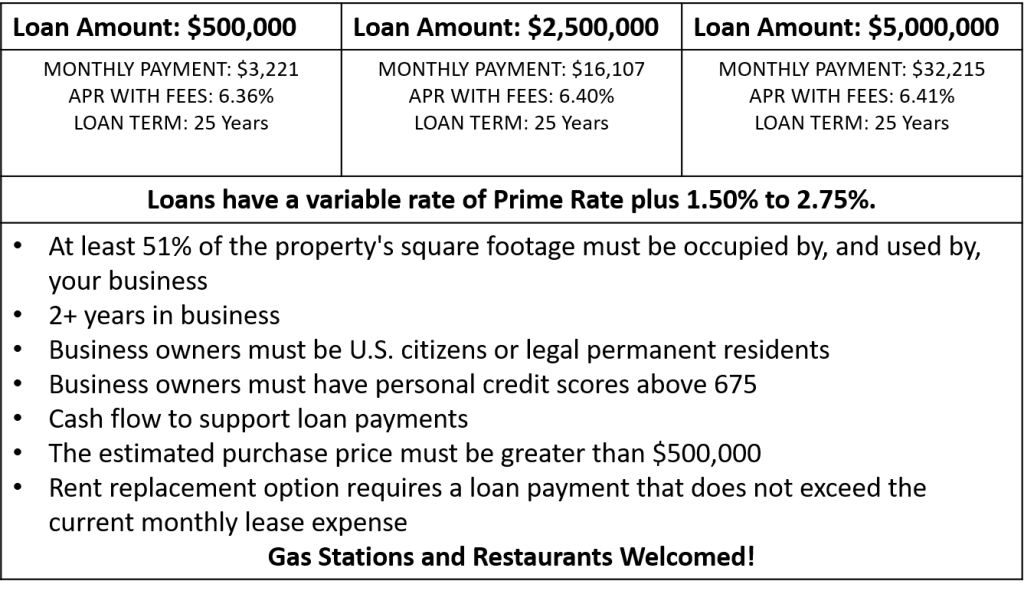

The Revenue-Based commercial property loan program offers loans from $250,000 to $5,000,000 at a reduced interest rate of 9 to 11%.

When you access revenue-based loan programs through The Network, you’ll benefit from the program’s low interest rates and fees and The Network’s fast, online process. We offer the Revenue-Based program to small businesses throughout United States seeking loans from $250,000 to $5,000,000.

Our simple online application makes it possible to apply for a loan in minutes, not hours. You’ll receive a decision in less than 48 hours and if approved, receive your funds in fewer than five business days. And, our flexible requirements make it possible to get funded even if you’ve been declined by another bank or loan institution.

Basic Revenue-Based Program Guidelines:

- Amount: $250,000 to $5,000,000

- Terms: Up to 7 years

- Interest Rate : 6 – 9.75%

- Eligible Use of Funds: Rent Replacement, Balloon Payment Refinance

Eligibility Criteria:

If you have strong cash flow and can demonstrate a history of paying your business obligations (including debts and taxes), you are a good candidate for a Rent Replacement loan.

The following requirements are the primary criteria for automatic approval for the program. Loans that do not meet all or some of these requirements may still be approved.

- Two or more years in business

- Cannot be behind on current rent payment

- Operating at break-even or positive cash flow

- An average credit score of 600 or above

- Free of open liens and judgments