The Benefits of Being Your Own Landlord

- Fixed Costs: Locking in your commercial mortgage long-term can give your business clear, fixed costs.

- Tax Deductions: The associated costs of owning and running a commercial space can provide tax deductions in the form of mortgage interest, property taxes and other items.

- Additional Income: Owning your office can offer the advantage of renting out extra office space adding another source of income.

- Retirement Savings: The prospect of owning commercial space and having the property appreciate over time, allows the owner to sell out and fund their retirement.

- Investment/capital gain. Chances are, over time the value of your building will grow. This adds to your company’s capital valuation. And, should you choose to sell the building you could realize that gain as income.

- Total control. As the building owner, you can make the decisions on how to improve, alter, expand and enhance the building. This control can have a positive impact on enhancing the building to improve the reputation and customer viewpoint of your business.

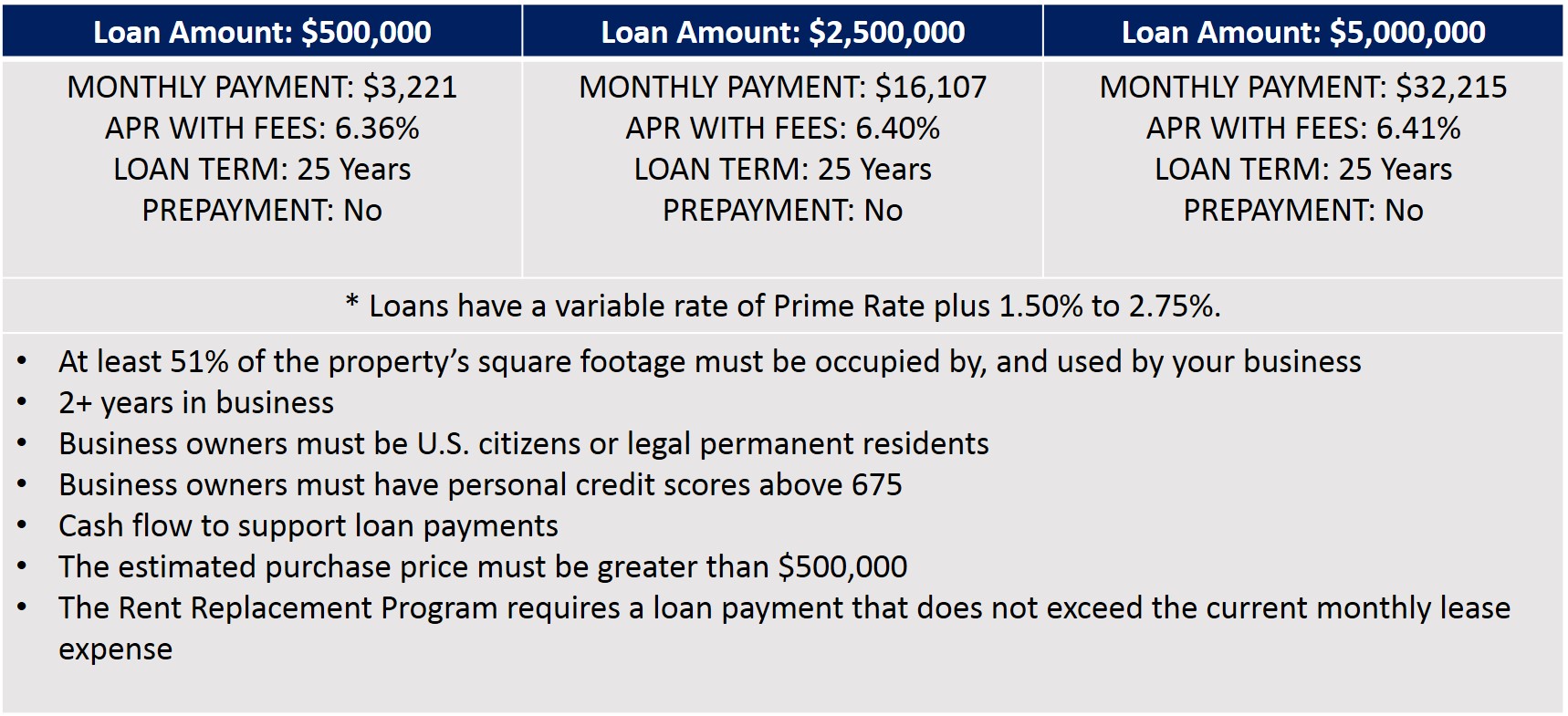

Click on the image below to see actual terms that have been approved by the Network lenders.

Don’t want to deal with banks? We have revenue-based lenders ready to help you get approved and funded. Learn more…